Native Instruments’ Insolvency Shock

Making a Scene Presents – Native Instruments’ Insolvency Shock

Listen to the Podcast Discussion to gain more insight into the Native Instruments insolvency!

What It Really Means for iZotope, Plugin Alliance, Brainworx, Kontakt, and Indie Artists Who Depend on Them

Native Instruments is not just another plugin company.

For many indie musicians and producers, it is infrastructure. Kontakt lives inside massive writing templates. Maschine defines entire beat-making workflows. Traktor runs live rigs. Reaktor holds years of personal experimentation. iZotope tools like RX, Ozone, Neutron, and Nectar are the safety net that lets a small team sound professional.

That’s why this news lands hard.

Multiple reports confirm that Native Instruments GmbH, the Berlin-based parent entity for Native Instruments, iZotope, Plugin Alliance, and Brainworx, has entered preliminary insolvency proceedings in Germany, with a court-appointed preliminary insolvency administrator assigned.

For indie artists, the fear isn’t abstract. It’s practical.

Is my work safe? Will my tools keep running? Did I just sink years of time into something fragile?

Let’s slow this down, separate fact from fear, and talk honestly about what this could mean—and how indie musicians protect themselves no matter how it unfolds.

What “Preliminary Insolvency” Actually Means (and What It Doesn’t)

First, an important reset.

Preliminary insolvency does not mean shutdown.

In Germany, preliminary insolvency exists for a very specific reason: to protect creditors while giving the company space to restructure. Once this process begins, a court-appointed administrator steps in to oversee major decisions. However, that does not mean the business shuts down. Day-to-day operations usually continue, employees keep working, products remain available, and customers often see little immediate change. The purpose is not to pull the plug. The purpose is to find a path that resolves debt while preserving as much value as possible.

That distinction is critical, especially for people who rely on these tools for their livelihood.

When a company owns valuable products, it makes no financial sense to destroy them. Assets with real market value need to keep operating because that ongoing value is what ultimately pays creditors. Tools like Kontakt, Komplete, and iZotope’s software are not disposable side projects. They are revenue-generating systems with large, invested user bases. In this type of insolvency process, those tools do not simply vanish overnight. Keeping them alive is part of the solution, not the problem.

But even when operations continue, uncertainty carries its own cost.

Unclear futures cause users to hesitate before buying or upgrading. Development can slow as decisions are delayed or reevaluated. Support teams feel pressure. And musicians—especially indie artists who depend on stable workflows—start questioning whether the time they’ve invested is safe. That doubt creeps into creative decisions, business planning, and release schedules.

That emotional weight isn’t overreaction. It’s rational. When your income depends on tools working tomorrow the same way they worked yesterday, instability anywhere in that chain feels personal. Understanding what this stage really means doesn’t erase the anxiety—but it does put it in context, and context is the first step toward making smart, calm decisions instead of reactive ones.

The Corporate Structure Problem: One Name, Many Entities

One of the biggest sources of confusion in situations like this is corporate structure.

Native Instruments GmbH sounds like it represents everything people think of as “Native Instruments,” but in reality, it doesn’t. It is the German parent entity, not the entire universe of companies, teams, and operations that users experience as a single brand.

Large music-tech groups are often made up of multiple legal entities spread across different countries. Some handle development, some handle sales, some handle distribution, and some exist specifically for acquisitions or intellectual property. Because of that, when one entity enters insolvency proceedings, it does not automatically pull every connected company into the same legal process.

This distinction is especially important for Plugin Alliance. Plugin Alliance has publicly stated that its U.S. and German entities are not part of the insolvency proceedings and that, at least for now, operations remain business as usual. That does not mean nothing can change in the future, but it does mean the current situation is not a blanket shutdown affecting every brand equally.

What this really tells us is that we are not watching a single domino fall.

We are looking at a complex web of companies, each with its own legal structure, financial exposure, and potential outcome. Some brands may pass through this period with minimal disruption. Others could be restructured, sold, or reorganized. For users, this means the impact will likely be uneven—and understanding that complexity is far more useful than assuming everything rises or falls together.

How Native Instruments Got Here: Expansion, Debt, and Consolidation

This story did not begin with bad products, and that distinction matters.

Native Instruments’ troubles are not the result of musicians abandoning its tools or the market rejecting its software. In fact, many of these products remain deeply embedded in modern music workflows. The shift began in 2021, when Native Instruments merged with iZotope under private-equity backing. The move was framed as a forward-looking strategy: build a larger, integrated music-creation platform that could compete at scale.

Over the next few years, that consolidation accelerated. Plugin Alliance and Brainworx were pulled more tightly into the group. Account systems, branding, and product positioning were increasingly unified. By 2023, the Soundwide name was officially retired, and everything was brought under the Native Instruments brand umbrella.

On paper, the strategy was logical. Shared accounts reduce friction. Shared infrastructure lowers costs. Bundled products encourage subscriptions. Predictable, recurring revenue is attractive to investors. From a corporate perspective, it looked like a modern, efficient way to build a sustainable business.

The problem, however, does not appear to be demand. It appears to be debt.

Public financial filings referenced by multiple reports show a stark imbalance between how much debt the company was carrying and how much it was earning. Even a business with strong products and loyal users can struggle when the cost of servicing debt outpaces its ability to generate cash—especially in a higher-interest-rate environment. At that point, the math stops working, regardless of how good the tools are.

This reframes the entire narrative.

The products didn’t fail. Musicians didn’t walk away. The market didn’t collapse. What cracked was the financial structure built around those tools. And understanding that difference is crucial, because it shifts the conversation away from panic about quality or relevance and toward a more sober discussion about ownership, leverage, and the long-term risks of consolidation driven by debt rather than by the needs of the people actually using the tools.

The Three Fears Indie Musicians Are Actually Feeling

When insolvency headlines hit, creators don’t worry about shareholders. They worry about survival.

Fear #1: Access and Activation

If installers, license servers, or accounts stop working, paid tools become unusable. Even a temporary disruption can derail sessions, delay releases, or break live rigs.

Fear #2: Updates and Compatibility

If development slows, OS updates, DAW changes, or Apple/Windows transitions become landmines. Tools don’t need to disappear to become unusable—they just need to fall behind.

Fear #3: Sunk Time

This one cuts deepest. Musicians don’t just invest money. They invest months—or years—learning workflows, building templates, creating presets, and designing careers around these tools.

Losing stability feels like losing momentum.

That fear is justified. But it doesn’t require panic. It requires planning.

Plausible Future #1: Restructuring With the Ecosystem Intact

The least disruptive outcome is also the most common in situations like this.

In this scenario, Native Instruments successfully restructures its debt while keeping day-to-day operations intact. Core products continue to function, support teams remain in place, and the company focuses on protecting the most valuable parts of its ecosystem. The changes users notice are rarely dramatic. Instead of mass shutdowns, the pressure shows up in quieter ways: pricing adjustments, heavier emphasis on subscriptions, tighter product bundles, and more aggressive incentives to stay inside the ecosystem.

From the outside, it can feel like business as usual—just with less flexibility and more financial gravity.

What This Means for Kontakt and Komplete

Kontakt is a crown jewel, and it would be treated as such in a restructuring. It anchors a massive third-party developer ecosystem and sits at the center of countless composition and production workflows. That kind of gravity gives it protection. As long as restructuring is successful, Kontakt and the Komplete ecosystem are likely to remain stable, supported, and actively maintained. Preserving continuity here protects long-term value, both for the company and for the broader library market built around it.

What This Means for iZotope

iZotope’s tools solve concrete, everyday problems for working musicians and engineers. Products like RX, Ozone, and Neutron fit neatly into modern narratives around “intelligent” and assistive audio tools, making them attractive in a revenue-focused restructure. Under this scenario, iZotope likely continues operating with deeper integration into the Native Instruments ecosystem and a stronger push toward recurring revenue models. The tools remain useful and relevant, but the business model around them becomes more tightly controlled.

What This Means for Plugin Alliance and Brainworx

If Plugin Alliance and Brainworx remain legally outside the insolvency proceedings, they may experience less disruption in the short term. Development and support could continue largely as normal, at least initially. However, even in this scenario, long-term strategy is not immune to change. Ownership pressure and revenue goals can still influence pricing, bundling, or subscription emphasis over time, even without immediate operational upheaval.

For indie artists, this future is not ideal—but it is manageable. The tools continue to work. Projects can move forward. The main adjustment is psychological and strategic: recognizing that flexibility may decrease and planning workflows accordingly, rather than assuming today’s access model will remain unchanged forever.

Plausible Future #2: Breakup and Asset Sales

This is the scenario that scares people the most—but it’s also one of the most common outcomes in situations like this.

When insolvency proceedings move forward, valuable assets are often separated and sold individually. Buyers are not purchasing legacy, reputation, or emotional attachment. They are purchasing revenue potential, market position, and future leverage. That distinction is uncomfortable for users, but it’s how these processes usually work.

Instead of one unified future, different products can end up on very different paths.

Kontakt in a Breakup Scenario

Kontakt is the most attractive asset in the entire portfolio. It is not just a plugin; it is an ecosystem that supports thousands of third-party libraries and sits at the core of modern composition workflows. That makes it highly valuable to buyers.

If Kontakt is acquired by a buyer who understands platform ecosystems, stability is likely to be prioritized. Preserving developer trust and user confidence protects long-term value. In that case, users may see relatively little disruption beyond gradual changes in pricing or licensing.

If, however, Kontakt ends up with a buyer focused primarily on short-term extraction, the risks increase. Licensing terms could tighten. Subscription pressure could increase. Access models could change. The product would still exist, but the relationship between creators and the platform could feel more transactional and less secure.

Maschine, Traktor, and Hardware-Centered Products

Hardware-driven ecosystems are more complicated in breakups.

Unlike pure software, hardware requires manufacturing, inventory management, repairs, warranties, and long-term support. That complexity makes these products less attractive to some buyers. As a result, their future depends heavily on who acquires them and why.

A buyer with a clear hardware strategy could keep these lines alive and evolving. A buyer focused purely on software margins might deprioritize them, leaving products technically supported but creatively stagnant. In breakup scenarios, hardware is often where uncertainty lingers the longest.

Reaktor

Reaktor occupies a unique space. It is deep, flexible, and beloved—but it is also complex, resource-intensive, and difficult to monetize aggressively.

Reaktor’s future in a breakup scenario depends almost entirely on whether a buyer sees long-term value in experimental platforms and advanced users. A buyer who understands Reaktor as a research and innovation engine could nurture it. A buyer focused on predictable revenue may see it as a cost center rather than a growth engine.

That doesn’t mean Reaktor disappears—but it does mean its development trajectory could change significantly.

iZotope

iZotope remains a strong, recognizable brand with tools that solve clear, everyday problems for musicians and engineers. RX, Ozone, Neutron, and Nectar all have defined markets and broad adoption, which makes iZotope attractive in a potential sale.

However, tighter integration with Native Instruments infrastructure over recent years makes separation more complex than it once was. Any buyer would need to untangle shared systems, accounts, and workflows. That complexity doesn’t make a sale impossible—but it does increase friction and raises questions about how clean the transition could be for users.

Plugin Alliance and Brainworx

If Plugin Alliance and Brainworx remain structurally separate from the insolvency proceedings, they may experience cleaner transitions—or even remain independent longer than other assets. Their plugin-focused business model is easier to transfer, easier to operate independently, and easier to monetize under multiple ownership structures.

That relative simplicity works in their favor in a breakup scenario.

The Real Takeaway for Indie Artists

The most important lesson here is not which product survives or who buys what. It’s this:

Not all sunk time carries the same level of risk.

Deep instrument ecosystems—especially those tied to proprietary formats and large libraries—are far harder to replace than mixing or utility plugins. Replacing a channel strip or EQ is inconvenient. Replacing an entire instrument world can mean rewriting your creative process.

Understanding that difference allows indie artists to make calmer, smarter decisions. Instead of treating all tools as equally fragile, you can prioritize protecting the workflows that would be hardest to rebuild—and plan redundancy around everything else.

Plausible Future #3: Quiet Shift Toward Subscription Lock-In

This is the stealth outcome.

There are no dramatic headlines. No breakup announcements. No clear moment where everything changes at once. Instead, the shift happens quietly. Pressure increases toward subscriptions, larger bundles, and account-locked access models. The ecosystem still works, but the rules slowly tighten.

Perpetual licenses don’t suddenly vanish. They remain available on paper. But over time, they stop feeling sufficient. New features arrive primarily inside subscriptions. Compatibility updates favor bundled plans. Support and convenience increasingly assume you are logged in, current, and continuously paying. Nothing is technically taken away, yet flexibility erodes.

For indie artists, subscriptions themselves are not the enemy.

Subscriptions can make sense when they are temporary tools—used to solve a specific problem, complete a project, or support a revenue-generating phase of work. They become dangerous only when they quietly turn into permanent dependencies. When a creative workflow cannot function without an ongoing payment, the subscription stops being a tool and starts becoming a tax.

That’s the real risk of the stealth outcome. Not that tools disappear, but that artists gradually lose the ability to step away without breaking their own work. Recognizing that shift early is what allows musicians to stay in control—choosing subscriptions intentionally rather than waking up one day to find their entire creative process locked behind a monthly bill.

Plausible Future #4: A Strategic Buyer Who Prioritizes Stability

What Indie Musicians Should Do Right Now (Without Panicking)

This is the part that matters most, because this is where anxiety turns into agency.

News like this can make artists feel powerless, as if everything they’ve built is suddenly at risk. The truth is, you have far more control than it feels like in the moment—if you focus on the right actions instead of the noise.

Step One: Secure Your Access

Start with the basics. Make sure you can actually access what you already own.

Log into your accounts and confirm everything works as expected. Verify that you know your usernames and passwords. Check that you can download installers and access your licenses from official sources such as native-instruments.com, izotope.com, and plugin-alliance.com. Don’t assume you’ll remember later or that everything will “probably be fine.”

This step isn’t about hoarding software. It’s about eliminating avoidable stress. When access is secure, you can make decisions calmly instead of reacting under pressure.

Step Two: Reduce Single Points of Failure

Next, look at your current projects and workflows with a practical eye.

Finish what you’re already working on using the tools you know. There’s no reason to derail active projects or creative momentum. At the same time, identify which tools are truly mission-critical. Ask yourself: If this one plugin or platform disappeared tomorrow, what would actually break?

Once you know that, identify at least one viable alternative for each critical role. You don’t need to switch today. You don’t need to rebuild your entire studio. You just need to know that you could pivot if you had to. That knowledge alone reduces fear and restores a sense of control.

Step Three: Convert Sunk Time Into Owned Assets

This is where long-term protection really happens.

Sunk time doesn’t have to stay sunk. You can turn much of it into assets you own. Print stems from important sessions. Export presets and channel settings wherever possible. Archive full sessions in a way that doesn’t rely on a fragile chain of live plugins. When working with clients, deliver consolidated files that can be reopened without recreating your exact environment.

These practices don’t limit creativity—they preserve it. Ownership beats dependency every time. When you own the outputs of your work, changes in tools become inconveniences instead of existential threats.

Step Four: Separate Headlines From Timelines

Finally, slow down the story in your head.

This is not a shutdown event. It is a process, and processes unfold over time. Watch for concrete signals—changes to licensing terms, installer access, support responsiveness, or product availability. Those are real indicators. Speculation, rumors, and social-media panic are not.

By separating headlines from timelines, you give yourself the space to respond intelligently instead of emotionally.

Taken together, these steps don’t just protect your tools. They protect your momentum, your income, and your peace of mind. And that’s the real goal: staying creative, productive, and in control no matter what happens next.

What This Means for Future Purchases

Right now, patience is power.

Moments like this create a quiet pressure to act—to buy, upgrade, or lock something in “just in case.” That instinct is understandable, but it’s rarely helpful. Decisions made from fear tend to solve emotional discomfort, not real problems. Don’t buy tools because anxiety whispers “what if.” Don’t upgrade simply to feel safer.

Instead, let purpose lead.

Buy tools only when they clearly protect your ability to work or increase your ability to earn. If a purchase doesn’t help you finish a release, deliver a client project, perform a show, or generate income, it’s not a priority—no matter how compelling the moment feels.

This is an important reset for indie artists.

Gear is not progress.

Progress is finished work.

Progress is releases, clients, shows, catalogs, and momentum.

Tools exist to support output, not to replace it. When you keep that distinction clear, you stay in control of your creative direction—even when the industry around you feels uncertain.

|  Spotify |  Deezer | Breaker |

Pocket Cast |  Radio Public |  Stitcher |  TuneIn |

IHeart Radio |  Mixcloud |  PlayerFM |  Amazon |

Jiosaavn |  Gaana | Vurbl |  Audius |

Reason.Fm | |||

Find our Podcasts on these outlets

Buy Us a Cup of Coffee!

Join the movement in supporting Making a Scene, the premier independent resource for both emerging musicians and the dedicated fans who champion them.

We showcase this vibrant community that celebrates the raw talent and creative spirit driving the music industry forward. From insightful articles and in-depth interviews to exclusive content and insider tips, Making a Scene empowers artists to thrive and fans to discover their next favorite sound.

Together, let’s amplify the voices of independent musicians and forge unforgettable connections through the power of music

Make a one-time donation

Make a monthly donation

Make a yearly donation

Buy us a cup of Coffee!

Or enter a custom amount

Your contribution is appreciated.

Your contribution is appreciated.

Your contribution is appreciated.

DonateDonate monthlyDonate yearlyYou can donate directly through Paypal!

Subscribe to Our Newsletter

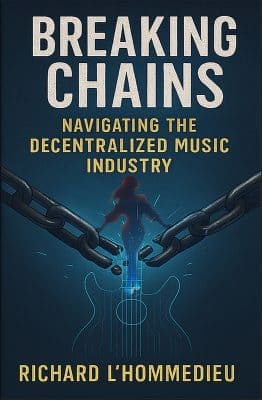

Order the New Book From Making a Scene

Breaking Chains – Navigating the Decentralized Music Industry

Breaking Chains is a groundbreaking guide for independent musicians ready to take control of their careers in the rapidly evolving world of decentralized music. From blockchain-powered royalties to NFTs, DAOs, and smart contracts, this book breaks down complex Web3 concepts into practical strategies that help artists earn more, connect directly with fans, and retain creative freedom. With real-world examples, platform recommendations, and step-by-step guidance, it empowers musicians to bypass traditional gatekeepers and build sustainable careers on their own terms.

More than just a tech manual, Breaking Chains explores the bigger picture—how decentralization can rebuild the music industry’s middle class, strengthen local economies, and transform fans into stakeholders in an artist’s journey. Whether you’re an emerging musician, a veteran indie artist, or a curious fan of the next music revolution, this book is your roadmap to the future of fair, transparent, and community-driven music.

Get your Limited Edition Signed and Numbered (Only 50 copies Available) Free Shipping Included

Discover more from Making A Scene!

Subscribe to get the latest posts sent to your email.